The Oil and Gas Free Zones Authority (OGFZA) has thrown its weight behind calls for a 10-year exemption for operators in oil and gas free zones from the new tax law.

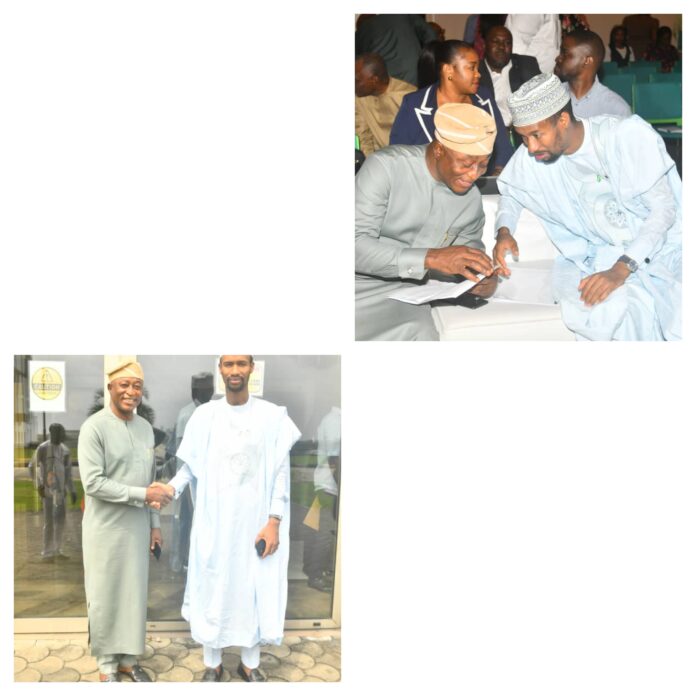

The Managing Director and Chief Executive Officer of OGFZA, Bamanga Umar Jada, made the call on Thursday in Onne, Rivers State, during a town hall meeting with the Federal Inland Revenue Service (FIRS) and OGFZA licensees.

Jada said the proposed 10-year extension would provide operators with the necessary “adaptation space” to transition and comply with evolving tax requirements.

“Accordingly, OGFZA supports the call for a ten-year extension of existing tax incentives, coupled with a phased implementation to mitigate potential disruptions. Many of our licensees, including prominent foreign investors, formulate strategies spanning 10, 15 or even 25 years, based on prevailing incentives,” he said.

He added that granting the transitional period would reinforce the Renewed Hope Agenda and ensure policy consistency, which he described as a cornerstone for attracting sustained investment.

The OGFZA chief disclosed that Nigeria’s free zones have attracted over $24 billion in investments, underscoring their strategic importance to the nation’s economy.

“Energy-oriented free zones have been pivotal in driving development in several countries, as seen in the Jebel Ali Free Zone in Dubai and the Sohar Free Zone in Oman. These initiatives have attracted billions of dollars in investments, created massive employment opportunities and positioned their economies as global leaders,” Jada said.

“Similarly, OGFZA-regulated free zones in Nigeria have secured more than $24 billion in investments, host over 200 enterprises, and have generated hundreds of thousands of direct and indirect jobs. This highlights the value of strong incentives and effective regulation in accelerating industrialisation,” he added.

Jada commended President Bola Ahmed Tinubu for his commitment to tax reforms and economic transformation, while also acknowledging the Minister of Industry, Trade and Investment, Dr. Jumoke Oduwole, for her guidance and advocacy in support of the sector.

He noted that under the Tinubu administration, exports from Nigeria’s oil and gas free zones have risen to 496,537,804 metric tonnes, generating significant foreign exchange inflows.

“Our operators now supply markets in Brazil, the United States, France, India, the United Kingdom, the Republic of Korea and beyond, in line with the President’s Renewed Hope Agenda,” he said.

Jada reaffirmed OGFZA’s readiness to sustain collaboration with FIRS, in line with their memorandum of understanding, to ensure tax reforms are implemented efficiently and fairly.

In his remarks, the Executive Chairman of FIRS, Dr. Zacch Adedeji, described the 2025 tax reforms as a major step towards modernising Nigeria’s fiscal framework.

Represented by his Special Adviser on Tax Incentives, Dr. Cletus Adie, Adedeji said the introduction of a tax clearance certificate as a mandatory requirement for the renewal of operating licences had become critical.

“For export processing and free trade zones, the focus is not on taxing income or profits, but on promoting transparency, accountability and proper reporting,” he said.

He explained that by embracing compliance and collaboration, free trade zones could better contribute to national development, which is the core objective of the Special Economic Zones scheme.

Adedeji also pointed to what he described as “continuous recalcitrant behaviour by some enterprises,” which had necessitated a structured administrative approach to compel compliance, in line with Section 72(4)(f) of the Nigerian Tax Administration Act.

Stakeholders at the meeting unanimously called for the exemption of operators in special economic and free zones from the new tax law provisions to enable a smooth adjustment period.